Otros

Read Ifc Markets Review To Find Out If It Is Reliable Fx Broker!

Cодержание

- Is Ifc Markets Trading Good?

- Ifc Markets Commission Fees

- Ifc Markets Forex Trade Platform And Broker Review

- What We Like About Ifc Markets

- Nettradex Trading Analytical Platform

- Is Forex Trading Taxable In Australia

- Does Ifc Markets Offer Demo Accounts For Forex Trading?

- Does Ifc Markets Offer Guaranteed Stop Loss?

- Are Ifc Markets Safe?

- Is Ifc Markets Regulated In Europe?

- Ifc Markets Trading Opportunities

If you’d like to trade forex or are thinking of switching brokers, read this article for Benzinga’s picks for the best forex brokers. I have opened an account with IFCmarkets.com more than one year.Pre-trade transparency, post-trade transparency, transferable securities, money-market instruments, best execution and customer protection. All these rely helped everyone to get started in Global Forex Market.

All reviews represent only their author’s opinion, which is not necessarily based on the real facts. Foreign exchange trading is a thriving industry in Australia. The sector is well-regulated by local authorities, ensuring high levels of safety and customer protection. The amount you may lose is potentially unlimited and can exceed the amount you originally deposit with your IFCMARKETS account. Added to this, the broker provides comprehensive articles on several topics, including Portfolio Trading and Spread Trading, as well as concepts such as the Portfolio Quoting Method, Pair Trading, and more.

You can trade a wide variety of instruments with IFC Markets over 143 instruments infact. Broker commissions are charged if the brokerage fulfills an order, cancels an order or modifies and order on your behalf. An account inactivity fee is a fee charged to the registered brokerage client. Over 13 years later IFC Markets has grown to offering retail investors Forex trading, Spread Betting trading, Social trading, and Share Dealing trading. We show reviews chronologically, and you can filter by star rating, language, location, or keyword.

There are many charts, reports and thematic features here. The project takes into account the fact that financial literacy of most beginners is a serious problem. Therefore, the site presents a list of materials in abundance and at an advanced level. The choice of trading accounts is small, but adequate, and it is nice to see that there are several demo accounts. In general, this broker offers everything a trader needs in a clear and convenient form.

Why is leveraged trade bad?

Leverage trading can be dangerous because it amplifies your potential investment losses. In some cases, it’s even possible to lose more money than you have available to invest.

IFC Markets deploys a complex account type structure geared towards its proprietary trading platform. Is regulated by the British Virgin Islands Financial Services Underlying Commission , and remains the primary brokerage unit. It holds a Professional Indemnity for Financial Institutions Insurance issued by AIG Europe Limited.

Is Ifc Markets Trading Good?

Financial regulation and license approval is essential. Investing online can be just as risky as any other kind of offline investment. As with any investment, it is important to know and research the company you are dealing with.

Overall our feeling is that you would be better served with an alternative IFC Markets broker. CFDs are leveraged products and can result in the loss of your capital. To start the process of opening an account with IFC Markets you can visit the IFC Markets trading platform here. Take time to look around the IFC Markets platforms and train yourself to think more systematically and logically about the markets. It’s a new skill-set for many, but it is what the market requires of you. To trade effectively with IFC Markets, it’s important to get a have a good understanding of the IFC Markets trading tools and the markets.

In terms of trading speed, IFC Markets makes use of the latest technology to ensure that orders are executed instantly at the quote of the trading terminal. IFC Markets ensures that there is no requoting for small and medium volumes, with large orders being sent directly to the liquidity provider. I’m a forex enthusiast turned writer from the University of North West, South Africa.

IFC Markets provides video tutorial guides to help beginners understand the distinctive features of CFD and Forex trading and also introduce them to fundamental and technical analysis. There are also video tutorial guides for using their various platforms. IFCM Cyprus Limited serves clients from the European Economic Area, while IFCMARKETS. CORP and IFC Markets Ltd serve clients from other parts of the world, including Asia, Africa, Eastern Europe, and Latin America. But the broker states that they do not provide trading services for residents of the United States, Japan, and Russian. IFC Markets allows Expert Advisors automated forex trading on their metatrader4 Platform software.

The traders have the choice of trading stock, indices and CFDs. More so, the platform has been optimized for both mobile and desktop use on different operating systems. The platform has been uniquely structures and traders have the opportunity to work with personal composite instruments .

A trading platform is in essence the software supported by a particular broker to execute trades on the Forex market. Deciding on the right platform is also an important aspect of selecting a suitable broker. Many Forex brokers offer various bonuses as an incentive for new traders to sign up with them. Ifc is not one of those traders which want only to take your money. Can tell anything special about the company but on the other hand there is no serious problems also.

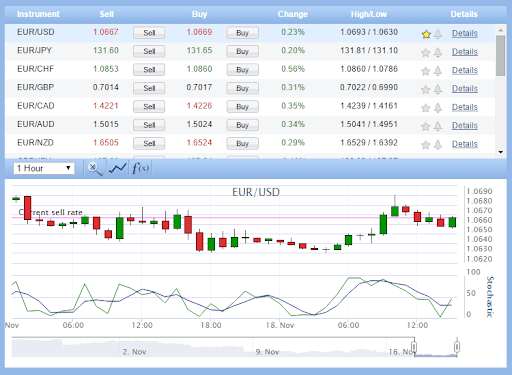

If you are uncomfortable with this level of risk, you should not trade spot Forex instruments and CFDs with high leverage, according to research. These educational tools range from the very fundamentals of Forex trading to more advanced Webinars and courses, which can also be of use to intermediate traders. These tools provide daily price history and live charts, along with a Top Gainers and Losers tool to immediately determine market movers based on a mathematical calculation. Reliable customer support is another important aspect of choosing the correct broker, as a lack of decent customer support can leave pressing issues unresolved and affect a client’s trade.

Trading instruments offered may differ based on the country of residence of the Client. Additionally, the trading instruments offered by IFC Markets may vary depending on the trading platform you choose to trade with. If you are no longer using your trading account close it with the brokers customer support. And make sure you have a confirmation that any remaining fees are not due. Often you have to visit and read many broker websites all of which have different uses of language.

This means your money in not held by IFC Markets directly by a tier 1 bank. The broker has no direct access to your funds so cannot misappropriate your money. Also IFC Markets is regulated by British Virgin Islands Financial Services Commission . You can start using the MetaTrader 4 platform with IFC Markets in multiple formats including through an online web platform, Through a downloadable application for Windows PC’s and Apple Macintosh computers. IFC Markets MetaTrader 4 is compatible with the latest macOS Mojave. IFC Markets allows traders to trade on mobile devices through Android and iOS devices like the iPhone.

Nonetheless, the overall quality and presentation are acceptable and will offer manual traders a variation of new ideas to consider. The educational section is excellent, presented in a combination of comprehensive written content and a wide range of videos. It offers a tremendous benefit at IFC Markets, and new traders should take full advantage of it.

Usually, the Forex bonuses are an exclusive or seasonal special offer. In general, Forex bonus types are also known by the name of a promotion. For a trader to make a profit or avoid making a loss on a trade, the price must move enough to make up for the cost of the spread. Nice conditions, fast execution, withdrawn within a day and many-many more.

This is a common jurisdiction for brokers to register in to avoid the stricter rules of other regulators. The broker is part of a larger group called the IFCM Group, which includes brokers in several different nations. Their use of the MT4 platform also leaves a lot to be desired. The platform is known for its technical tools used to assist you in performing analysis.

Ifc Markets Commission Fees

Compare the best copy trade forex brokers, based on platform, ease-of-use, account minimums, network of traders and more. IFC Markets provides continuous index and commodity CFDs trading, providing clients 24/5 access to assets. The most extraordinary feature at this broker is labeled the Portfolio Quoting Method; it allows traders to create unique synthetic assets, including equity versus equity quotations. IFC Markets applied for a patent, which is pending a response.

The creation of personalized trading instruments is an emerging trend; by 2025, it is likely that feature will become a core service provided by a majority of brokers. The inclusion of the Portfolio Quoting Method provides IFC Markets with a distinct competitive advantage and is appealing to committed traders and portfolio managers alike. When opening a trading account with IFC Markets, you will need to sign up here. Once you have received your login details by email, submitted your identification documents for account validation, and made a deposit; the next step is to download the trading platform of your choice. You can find detailed guidance on IFC Markets trading platforms here. You will need to provide some basic documentation to prove your identity as part of IFC Markets onboarding and normal KYC identity checks.

Forex regulation is therefore all about consumer protection. Regulated Forex brokers are less likely to cheat their clients and where such infractions happen, regulators are empowered by the laws of their respective jurisdictions to apply appropriate sanctions. Now many people are familiar with brokers using email, live chat and telephone but not many of them use Skype. This would be good for the IFC Markets broker if they used it properly. This is because most spot Forex instruments and CFDs may be highly leveraged, with a relatively small amount of money used to establish a position in assets having a much greater value.

The company has procedures and guidelines designed to address them promptly and fairly. IFC Markets, headquartered in Cyprus, is one of the leading regulated brokers in CFD and Forex markets. IFC Markets has expanded the range of services and has been focused on the development and implementation of innovative approaches to trading.

Of course, the broker is not perfect, but I’ve been trading with this broker for already a long time and I’m not going to change it. Ifc markets is checked by time and personal experience, a quite stable and good broker, so I don’t see a reason to change anything. What to mention about my experience with this broker? 3 years of stable earnings, not yet big, depending on my deposits.

- Try creating two accounts when you are working with IFC Markets.

- However, the efficiency of transactions depends not only on the broker.

- Really pleased with customer service provided by IFC Markets, I will recommend You.

- IFC Markets is a Cypriot broker and one of the leading regulated brokers in the CFD and Forex markets and is licensed by CySec, BVI, FSC and LFSA.

- In compliance with AML regulations, the name of the trading account and payment processor must be identical.

Forex trading, also called currency or FX trading, involves the currency exchange market where individuals, companies, and financial institutions exchange currencies for one another at floating rates. The platform may also provide tools for research in addition to tools for order processing. Bonuses that are known as rebates are credited to the trader’s account once they have completed a trade, while regular bonuses may require traders to carry out quite several trades first.

Ifc Markets Forex Trade Platform And Broker Review

Brokers who conduct business without regulation do so at their own discretion and pose a direct risk to the security of their clients money. IFC Markets Autochartist provides the world’s first Market Scanner available for MT4 using a non-trading Expert Advisor script. Scan markets for trading opportunities while viewing all symbols and time intervals from a single graph.

Brokers that charge higher minimum deposits often offer additional premium services on their platforms that are not available for free on other platforms. As I got a bit more experienced, I started trading instruments I created myself – their Netradex platform allows that.. It’s not that easy to switch from one platform to another, but that’s the matter of time. Not to lose money, I avoid trading before and during important events, so no requotes can scare me.

Moreover, the author’s development allows you to build an Expert Advisor with the help of a simple programming language NTL +, to put up any types of orders, to receive the latest financial news, etc. When a trader’s equity in a Micro account reaches or exceeds the maximum allowable amount of $5000, the opening of new positions will be automatically suspended. To continue trading, the client must either change the account type to a standard account or withdraw the excess funds to reduce the capital to $3000 or lower. IFC Markets has recently added a new analytical tool called Top Gainers and Losers, which right away calculates market movers.

It is a common myth that online trading is confusing. It is only difficult for people who have not done the research. In this article, you will learn important information regarding IFC Markets that will help you get off to a good start in the world of online trading. All information on 55brokers.com is only published for general information purposes. We do not present any investment advice or guarantees for the accuracy and reliability of the information.

It also has been involved in major projects concerning the market. A good example is the development of financial technologies, the broker being part of IFCM Group. In addition to providing top-quality trading platforms that include MT4/5, the broker provides an impressive market education section on its website. This makes IFC Markets suitable for beginning and new traders.

Understand that the MetaTrader 4 trading platform was developed primarily to trade Forex but you can also trade other types of financial instruments through CFDs and Spread Betting. You will not be able to trade Stocks, Indices, Commodities, ETFs, Futures on any MetaTrader 4 platform unless they are CFD contracts or Spread bets. You will not own any underlying assets with CFDs or Spread bets as you are speculating on price movements with IFC Markets. MetaTrader 4 also known as MT4 is the number one trading platform on the planet and has been in active use on financial markets since 2005.

Client support in many languages, sure you will find the one convenient for you. MetaTrader4 is arguably one of the most popular trading platforms on the market, for its ease of use, broad-based compatibility, and host of charting tools. Starting from fixed spread, ending with a reliable regulator, the execution of orders is normal. All information presented on TopBrokers.com website, including charts, quotes and financial analysis, is informational and doesn`t imply direct instructions for investing. TopBrokers.com will not accept any liability for loss or damage as a result of reliance on the information on this site.

What We Like About Ifc Markets

MetaTrader4is among the most popular platform in the Forex market. It offers a user friendly interface that promises and offers the traders with the best trading experience. The platform also provides the traders with charting packages and indicators. More so, the traders get an added benefit of having Expert Advisors . IFC also incorporated MetaTrader5 in its trading operations.

Discover the best forex trading tools you’ll need to make the best possible trades, including calculators, converters, feeds and more. The broker offers multichannel live support 24/5 in 12 languages, in addition to its multifunctional website that is available in 19 languages. You can contact IFC through Live Chat, email, Skype, Super profitability Facebook Messenger, WhatsApp, Telegram, Discord, Instagram and Signal. Or Canada, you can contact the broker via phone or request a callback. Founded in 2006, IFC Markets is a popular forex and contracts for difference broker that provides high-quality trading services to over 185,000 clients from more than 80 countries.

The instruments range including the standard ones along with synthetic instruments created by experts and availability to create own one. IFC Markets traders are offered a calendar of economic news on commodity markets to help them stay ahead of the events in the market. Users can highlight news on individual product groups and also view the news for the selected period of time. IFC Markets provides an introduction to foreign exchange market guide, technical analysis tutorial, fundamental analysis tutorial and also a forex trading psychology tutorial lesson. This will depend on the deposit method that the trader used when they deposited funds with IFC Markets.

Working with IFC Markets Forex broker is a smart move on the traders’ ends as IFC Markets is a broker one can count on. Its tight regulation makes it a broker that the traders can trust with their funds. More so, it offers the clients with a good trading experience, which is the perfect combination of a forex broker that one should be working with.

It provides 10 instruments which have shown the highest increase and biggest decrease for selected period of time . Traders may compute Gainers and Losers according to the selected instrument group – stocks and shares, currency pairs, precious metals, indices, commodities, gold instruments, ETFs, PCI library. Once a week a new analytical article is published based on this tool. Clients at IFC Marketplaces are provided with a host of educational materials on financial markets. Weekly market analysis is shown in video variety, and Marketplace Sentiment is published once a week, Technical Analysis and Industry Data including Price Background and Live Charts are submitted daily.

What type of broker is KOT4X?

KOT4X is an online Crypto, Forex and CFD Broker providing traders across the globe with cutting-edge technology to trade the world’s markets.

Traders should also keep in mind potential hidden fees that some brokers might charge, which include inactivity fees, monthly or quarterly minimums, and margin costs. For every trade placed, the trader will have to pay a certain amount in costs or commissions. These costs vary from broker to broker, but they are usually a relatively low amount and are often the only cost of trading which a trader is likely to incur. The cost of trading is the overall expense that a forex trader incurs to run their trading business. The company also offers swap-free Islamic accounts, which do not charge interest and are therefore Sharia-compliant. Most forex broker firms handle only a very small portion of the volume of the overall foreign exchange market.

The investment value can both increase and decrease and the investors may lose all their invested capital. Under no circumstances shall the Company have any liability to any person or entity for any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to CFDs. There are Islamic accounts, which are swap free, and VIP accounts, which require a minimum deposit of 50,000 USD/EUR or 5,000,000 JPY. Demo accounts are also available that enable you to try the different platforms and practice your trading strategies with virtual funds. Right from the time it was developed in 2005, the MetaTrader 4 trading platform has been very popular among traders all over the world.

Once a week a new analytical article is published based on Top Gainers and Losers. IFC Markets has a number of unique features which make it stand out among other brokers. The main one is thatIFC Markets offers fixed and floating spreads providing traders with an opportunity to pick the one which very best corresponds to their trading strategy. Transactions in this market are always between a pair of two different currencies, so forex traders either buy or sell the particular pair they want to trade. Forex brokers may also be referred to as retail forex brokers, or currency trading brokers.

Demo version, presented by any company, gives an opportunity to users to study the behavior of various assets in more detail and build their own trading strategy. And, for this purpose, the trader uses virtual means and is not afraid to lose the real ones. IFC Markets provides clients with a demo account to test their trading skills and learn the functionality of trading platforms. Testing can be carried out using virtual dollars, euro, yens and bitcoins on the balance. The broker offers the free demo account both for NetTradeX and MetaTrader 4 and 5 platforms. You can also take advantage of a free demo account that allows you to gauge the broker’s services and develop a trading plan.

An accommodating exchanging diagram by the instrument is offered on the specialist’s site split by CET time region and UK neighborhood exchanging hours. IFC Markets offers Islamic exchanging accounts with no trade charges. IFC Markets offers advancements for existing customers at the hour of composing, including prize draws, commission reference prizes, and month-to-month rewards depending on exchanging volume. New dealers can get a 30% store reward following a $250 installment, a further 30% movement reward, and are additionally gone into an attract to win a Tesla. The least store prerequisites fluctuate by account type. The minor store is $1 or comparable for the amateur/miniature record, ideal for less experienced or new merchants.

Nettradex Trading Analytical Platform

Conclusion of a contract with MetaQuotes Software to provide MetaTrader 4 trading terminal to its traders. The table on the website clearly shows the interest rates depending on the trade turnover. One of the distinctive features of the company is that it does not offer «super beneficial» bonuses, as it happens with many unlicensed competitors. Receiving asset quotes without delay helps a trader to make the right trading decision.

Clients can contact the support team in several ways, including through email, Live Chat, Call Back, Skype, Phone, WhatsApp, Telegram, Trading desk. The instruments of this group allow investing in the price dynamics of the crypto-currencies. Equity or stock indices are actual stock market indexes that measure the value of a specific section of a stock market. They can represent a specific set of the largest companies of a nation or they can represent a specific stock market. Check out the best Forex Broker reviews in the world.

A market maker speeds up trading as a market maker will purchase your stocks and commodities even is a buyer is not lined up. The minimum deposit to trade with IFC Markets is 1000. We have covered allot in this IFC Markets review, If you want to see how IFC Markets compares side by side with other brokers check out our IFC Markets Vs pages. As with most brokers, margin requirements do vary depending on the instruments. IFC Markets withdrawal fees vary depending on your selected withdrawal payment method. When choosing a broker like IFC Markets the administrative body and regulatory status of the broker is very important.

Choosing an online broker like IFC Markets can be difficult. For a beginner, the first few hurdles can come in the form of what appears to be a complex mobile or online trading platform, hard to understand investment terminology and confusing fee structures. In our review of IFC Markets we breakdown the pros and cons. What IFC Markets are able to offer, what countries IFC Markets are available in.

Now the program «Annual Interest on Free Money» is valid. It is beneficial for those traders, whose free funds on deposit will not participate in trading. Thanks to them, the owner will receive a monthly fee as a percentage of the amount involved. In fact, this is the percentage of free margin charges. The broker offers to customers its own trading platform NetTradeX, as well as MetaTrader 4 and MetaTrader 5 platforms, the most popular by traders. An Islamic Forex account is a halal trading account that is offered to clients who respect the Quran and wish to invest in the Islamic stock market following the principles of Islamic finance.

Is Forex Trading Taxable In Australia

Any payments funded to IFC Markets accounts by traders are held in a segregated bank account. For added security IFC Markets use tier-1 banks for this. Tier 1 is the official measure of a banks financial health and strength. IFC Markets have a D grade support rating because because sometimes the response was slow or our query wasnt answered.

Does HotForex use capitec bank?

Unlike most international Forex and CFD brokers, HotForex offers free online bank funding for clients who have online bank accounts with major South African banks. This includes African Bank, Bidvest Bank, Capitec Bank, FNB, Investec, Nedbank, Standard Bank and TymeBank.

IFC Marketsoffer a good selection of educational resources. Take your time, learn how the financial markets move. Take the time to learn how your trading platform works.

Does Ifc Markets Offer Demo Accounts For Forex Trading?

To open a genuine record with IFC Markets, brokers need to adhere to the online enrollment guidelines, including confirmation of home and character documentation. Unfortunately, we do not provide services to clients from Iran and North Korea. IFC Markets have a very good and professional customer service.

One of IFC Markets’ most notable features is its proprietary GeWorko Portfolio Quoting Method that allows you to create and trade your own financial instruments. You can also trade the personal composite instruments created by the IFC Markets team. These include a high-tech index, gold versus Brent oil, the DJIA versus the euro, and the Russian ruble versus the Japanese yen. In-house research consists of brief written analytics and video content. Surprisingly, it appears the analyst is researching on the MT4, rather than the NetTradeX platform.

Their tutorials and analytics helped me a lot when I was making my first steps in Forex trading. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Comments including inappropriate, irrelevant or promotional links will also be removed. NetTradeX appears to be a clone of the popular MT4 trading platform.

I’m new to trading, and my friend invited me to trade with IFC Markets. I started with a demo account, and 3 months ago switched to a live account, I’m satisfied so far. Hello everyone stop losing your hard earn money to fake brokers, if you are interested in trading binary option, recovery of lost funds from those heartle… IFC Markets, in addition to trading currencies in the Forex market, also begins to provide CFD trading.

Generally, the customers’ safety enabled through various ways with funds segregation, participation in schemes, as well IFCMARKETS. CORP. holds Professional indemnity for Financial Institutions Insurance in AIG EUROPE LIMITED.

In addition, IFC Markets offers an extensive educational section that novice traders should find very helpful. Dealing spreads at IFC for forex trades start at 0.4 pips for floating spread and 1.8 pips for fixed-spread accounts, although spreads increase depending on the trading platform and currency pair. CFD trades incur a minimum commission of 0.1% of the traded amount, which amounts to $0.02 per share for U.S. stocks. For more information on share commissions in other markets, click here. The business model is based on transparent and trustful relations with the clients through established STP execution with a range of platforms, including the proprietary platform with powerful features. Besides, the broker supports you with education and customer service in multiple languages along with accounts to choose from.

Banks and payment processors likely won’t be able to help. Any international cases would take years to handle through the courts. Contact us today for a free consultation and to start recovering your funds. Most traders are familiar with their extensive range of features. The broker also has its own platform called NetTradeX. There is a version for Windows and apps available for both iOS and Android devices.

In the forex market, currency unit prices are quoted as currency pairs. For accounting purposes, a firm may use the base currency as the domestic currency or accounting currency to represent all profits and losses. All things considered, you would be better off avoiding IFC Markets forex broker. » Visit Review 72% of retail CFD accounts lose money.

Also, you may get the VIP status and get flexible trading conditions, exclusive personal instruments, free access to a VPS, 0 commissions on deposits and withdrawals and much more. Besides to the real trading accounts, the IFCM allows free Demo account which operates with virtual funds and is intended for studying or the functional purpose to test strategies. After the registration, you will need to confirm your email address and upload your means of identification and proof of address.

Does Ifc Markets Offer Guaranteed Stop Loss?

Thanks for your review, but a few things, I guess, need to be updated, such as account currency and trading platfomrs, but not a big deal. This company keeps improving their service month after month. Easy to trade with them and get your profit withdrawn. I’m always abreast of latest news and events on the market, have access to free analytics and educational materials, which is more than just fine. Really pleased with customer service provided by IFC Markets, I will recommend You.

In addition, people can get to online assets, including YouTube content, an exchanging glossary, market PDF direction, just as edge and benefit number crunchers. The IFCM Group is a worldwide agent gaining practical experience in various instruments, including forex, CFDs, items, files, ETFs, and crypto prospects. Our audit conceals how to finish the paperwork for a live record, the diverse store strategies, free MT4 and MT5 stage downloads, and then some. IFC Markets brings to the market the innovative Portfolio Quotation Method.

Plus, if you fund a trading account, you qualify to win one of the great prizes offered by the broker. Choosing IFC Markets can make sense whether you’re a novice trader or have years of trading experience. The main downside of this broker relative to some of its competitors is that it lacks a major regulator, although it is overseen by 3 minor regulators. DailyForex.com adheres to strict guidelines to preserve editorial integrity to help you make decisions with confidence. Some of the reviews and content we feature on this site are supported by affiliate partnerships from which this website may receive money.

What is 20x leverage?

The fact that you chose 20x in the menu only means that 20x is the maximum leverage you can get, and in this example, you can add up to $19k to your position size (or open other positions worth up to $19k). … But, if it goes down 10% while you’re leveraged 10x, you’ll lose the whole $100 instead of $10.

IFC Markets provides highly-qualified customer support in 18 languages. Traders can get in touch with IFC Marketplaces through email, call Back, Mobile phone, WhatsApp, Telegram, Trading desk. The commodity pairs, or commodity currencies, are those forex currency pairs from countries with large amounts of commodity reserves. Traders and investors looking to gain exposure to commodity price fluctuations often take positions in commodity currency pairs as a proxy investment to buying commodities.

Are Ifc Markets Safe?

Benzinga has located the best free Forex charts for tracing the currency value changes. We may earn a commission when you click on links in this article. This broker is venturing into this sector but currently lists only two assets. We hope you found our review of the IFC Markets brokerage firm useful. IFC Markets is regulated and well established having been in business for over 13 years. If you would like to see how IFC Markets stands up against other brokers you can read some of our IFC Markets comparisons below.

However, the standing of this administrative board is problematic because of the restricted limits for organizations to enroll. So, the business guarantees that customer reserves are held in solo records. Withdrawal handling times shift by installment strategy, and some are dependent upon a charge. However, there is no restriction to the number of withdrawals that can be mentioned. See the merchant’s site for further subtleties in your ward.

And I don’t have any complaints about them, plus on mt4 the terminal works very well and doesn’t let you down. The broker has a fixed spread, profitable deals don’t get cancelled and they withdraw profit fast. It is also pity that this is actually a problem because there are other forex brokers out there that may not incorporate Skype into their customer service line up but still treat their clients with respect.

The provincial financial regulator for the Canadian province of Manitoba, the MSC, issued a warning against doing business with IFC Markets in April 2020. The broker does not have the required registration to offer financial services to Canadian services. The regulator claims that, despite this, the broker has ifc markets review been targeting residents of Manitoba through online classifieds. While IFC Markets technically offers a Micro account with a minimum deposit of just $1, the minimum deposit to access most features through a Standard account is $1000. Most similar brokers require only $100, with some going as high as $250.

IFC Markets offers various trading accounts with fixed and floating spreads for each of the trading platforms. As more and more online trading platforms have entered the market, minimum deposit requirements to open a live trading account have gone down as an increasing number of brokers compete for new clients. A demo account is available on any of the three platforms. In addition, Islamic users can open an Islamic trading account where swaps are not calculated.

In addition, there are extensive articles on various topics, including a whole series on portfolio trading and one content on spread trading. The articles in the «our innovations» section include concepts such as portfolio quote method, pair trading and much more. An economic calendar with global financial events and different time zones is available and detailed.

Try continuous index CFDs if u are new to market, sure you’ll love it. WHAT ABOUT “E.g. Card transfers minimum is 10$ with 2% + 7.50$ commission above, while CashU charges no fees. Basically, all the info on official web-site totally represents the true information.

The broker has oversight from the British Virgin Islands Financial Services Commission as well as the Labuan Financial Services Authority in Malaysia. The conditions haven’t changed, I’m trading as before. The deals I prefer to be in the long term, the profit from each deal is about 30-40% of the deposit. IFC Markets offers traders up to 7% annualized interest on free margin, depending on prior trading volume. Multi-lingual customer support is provided Monday through Friday between 0700 and 1900 CET. Support is easily reached via multiple messengers and live chat, while e-mail is equally supported, together with a call-back option.

VIP status and conditions are offered to exclusive clients and are automatically assigned to accounts with a trading deposit of $50,000 or more. The VIP package includes flexible trading terms, exclusive personal tools, free access to VPS, 0 deposit and withdrawal fees and up to $10,000 upfront deposit to your trading account. IFC Markets is a Forex market leader providing traders with an assortment of trading instruments. Traders are allowed to trade commodities, CFDs, precious metals, currency pairs and so on, on its trading platforms. IFC Markets is registered by Financial Service Commission . The broker boasts vast experience in the market and has scooped various awards.

Some deposits will also add on processing fees and other are offered for free for example Credit Card payment. The minimum IFC Markets account opening requirement is 1$ as a start for Beginning account based either on floating or fixed spread demand only. The deposit minimums are diversified by the funding option along with applicable commissions or without them. This publication is a marketing communication and does not constitute investment advice or research. Its content represents the general views of our experts and does not consider individual readers’ personal circumstances, investment experience, or current financial situation. Trading in CFDs carries a high level of risk thus may not be appropriate for all investors.

Is Ifc Markets Regulated In Europe?

Safety is evaluated by quality and length of the broker’s track record, plus the scope of regulatory standing. Major factors in determining the quality of a broker’s offer include the cost of trading, the range of instruments available to trade, and general ease of use regarding execution and market information. IFC Markets was founded in British Virgin Islands in 2008.

The rest of the options transfer capital from one to three days. The broker does not charge any additional fees for this, moreover, when using some payment systems, it pays this fee itself. IFC Markets is an STP broker (Straight-through processing – automatic realization of transactions with financial instruments).

IFC Markets is considered good and reputable to trade with IFC Markets. IFC Markets is used by over 10,000 traders and IFC Markets users. IFC Markets offers Forex trading, Spread Betting trading, Social trading, and Share Dealing trading. IFC Markets allow you to execute a minimum of trade of varies. IFC Markets allow you to execute a maxium trade of varies.

From time to time I like to peek in on this broker’s site to kill an hour or two trading. Traders may use bank wires, credit/debit cards, WebMoney, OKPay, and Western Union. Regional alternatives are additionally available and specifications given in the back-office.

Islamic Accounts are special accounts that are exempted from swap charges when forex traders transfer their position to the next session. The Islamic Account option is offered only to Muslim forex traders who follow the Sharia Law, which prohibits transactions that have certain interest for loans of money. Forex traders can select their trading platform, account type, leverage ratio, and account currency. Once a forex trader meets the conditions above, they can register a forex trading account to use the services of IFC Markets. The specialist gives fixed spreads to all instruments separated from stock CFDs. The base spread offered by IFC Markets is 1.8 pips across all record types, and this incorporates significant cash combines like EURGBP and EURUSD.

A broker may charge a commission fee as a service charge for facilitating the buying and selling of financial assets through your trading account. With IFC Markets you will need a minimum deposit of $1000. You can sign up for a demo account to acquaint yourself with IFC Markets platform. I’d recommend IFC Markets, as they provide the best services in the market, they’re suitable for both beginners and more advanced traders. Now they send a few trading ideas on a daily basis, which doesn’t let you to miss anything significant. For these 2 years I had no problems with my orders, or any payments.

MetaTrader 4 trading platform is very common among traders, because most speculators know its distinctive features. Its functionality allows you to safely perform trading operations due to the reliable encryption. Many built-in indicators help to conduct financial market research and solve various trading problems. In any case, having such a significant arsenal of tools, a trader will always be able to identify and use any market movement to make a profit. IFCMARKETS. CORP. holds professional lndemnity for Financial Institutions Insurance in AIG Europe Limited – by this link you can see the certificate of insurance. I already have quite a lot of experience in trading on ifc markets.

Ifc Markets Trading Opportunities

To me they are good one, though my experience of trading is not too much but I think with them I will gain lots of new info and experience. I didn’t manage to find a lot of advantages of IFC Markets. But it provides really fast execution and this is very important for me.

The MetaTrader platforms also have web-based and desktop versions. No minimum deposit is required to open a NetTrade beginner or MT4/5 micro accounts, although a minimum deposit of $1,000 is required to open standard NetTrade or MT4/5 accounts. Leverage ratios depend on the type of account and instrument traded. IFC Markets provides its clients with some of the best customer service options in the industry and has its own Customer Relationship Management software that provides clients with excellent support. IFC also provides a blog and full technical support for Autochartist, including expert advisors. IFC Markets are considered safe as they are regulated by and checked for conduct by the British Virgin Islands Financial Services Commission .

Trading spot Forex instruments and CFDs may not be suitable for all investors. You may lose a substantial amount of money in a very short period of time. IFC Markets provides excellent customer support from a team of highly qualified members, in 18 languages, available 24 hours, five days a week. This additional regulation makes IFC Markets a safe broker, as CySEC is a European authority that demands strict compliance and supervises the company’s overall investment activities. The instruments of this group allow trading indices of leading stock exchanges. The price of instruments is expressed in the local currency of each particular index.

You can ask any question and discuss about IFC Markets Broker with other traders. OPENING THE GATES OF FOREX – You may have asked yourself why you are getting interested in the Forex market, what attracts you that much and why you have decided to start trading. Actually, there may be many reasons, but let us note that the most important one is the independence.The Forex dealer advancement of the Internet made the […]… The basic truth about binary investment is the same old story, knowledge is key and information is power, those will never get old, I’m not the type that wi… We will always remind you here that anyone, promising to help you trade/ recover your funds/ manage your account / gain huge profits in…

When trading financial assets with IFC Markets like Forex trading, Spread Betting trading, Social trading, and Share Dealing trading. You should have confidence in IFC Markets and know that the management of your financial investments on the IFC Markets platform are in good hands. As broker fees can vary and change, there may be additional fees that are not listed in this IFC Markets review. It is imperative to ensure that you check and understand all of the latest information before you open an IFC Markets broker account for online trading.

Stormgain Review

ECN, electronic communication network, interbank execution of orders. Broker Review details of the license, registration and regulation of this FX broker cannot be found on the broker’s website. Get up to 50% bonus on your deposit and many other cool prizes. Ability to use hedging while trading on this account. An initial deposit of 1,000 USD, EUR, or 100,000 JPY. IFC Markets has Nasdaq, and as a Nasdaq owner, offers indices as CFDs.

When you send in a withdrawal request to IFC Markets, this will be honored. If they violate any regulatory rules their regulated status can be stripped. We spent over 3 months examining IFC Markets in depth. Although we found some very useful aspects of the IFC Markets platform that would be useful to some traders.